These recently released stats may hold the key to determining just how busy agents can expect to be for the rest of the year.

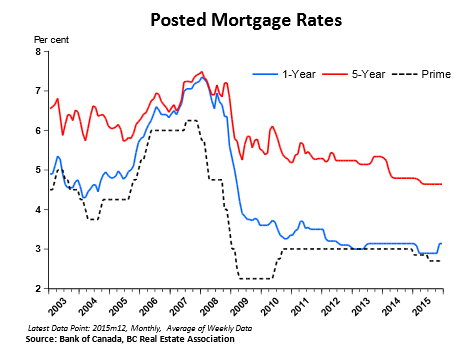

The British Columbia Real Estate Association published its mortgage rate forecast Thursday and if it prediction proves true, agents can expect potential buyers to continue flocking to the market in a bid to take advantage of record-low rates.

“We expect that weak economic growth will continue in the first quarter of 2016, but the possibility of an effective fiscal stimulus, a stronger US economy and a stabilization of oil prices points to stronger growth ahead,” BCREA said in its report. “The door remains open for the Bank of Canada to reduce rates once more in 2016, though our expectation is that the Bank will remain on the sidelines throughout the year.”

Economic volatility is expected to keep rates at their current basement bargain levels, according to the association which notes economic growth increased a mere 1.2% in 2015.

“The main factors weighing on the economy remain present in 2016, namely low oil prices and the associated knock-on effects on incomes and job growth in large swaths of the Canadian economy,” BCREA said.

Of course, rate levels are just one tool that can be used to estimate buyer sentiment. Prices, regional struggles, and volume levels also play a roll, as well as provincial-specific economic conditions.

However, record low rates will likely encourage clients to purchase now as opposed to delay until a later date. Low rates also impact home prices, with many clients willing to pay more for a home knowing their payments will be lower.